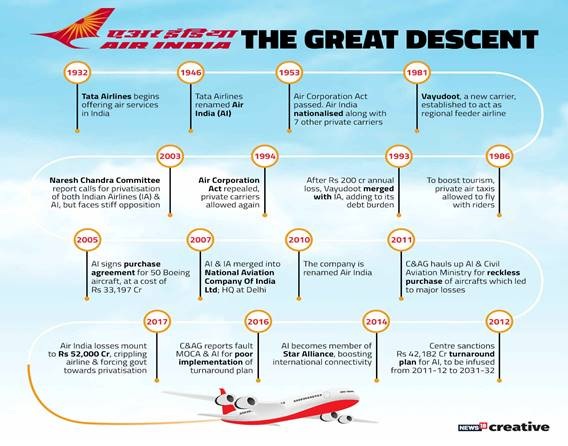

Air India Divestment

Why is it in the news?

- Minister of State for Civil Aviation told Parliament that the government may launch its second attempt to privatise the national carrier before the end of August.

- The Centre for Asia Pacific Aviation (CAPA) has recommended that the government allow FDI for a higher number of bidders and increased valuation for Air India.

- According to CAPA, a second attempt at disinvestment of Air India is likely to see strong interest from private players.

More in the news

CAPA Recommendations:

- There is a likelihood of international entities seeking to form joint ventures with Indian companies to bid for Air India to comply with norms that cap foreign direct investment into the national carrier at 49%.

- Allow FDI for a higher number of bidders and increased valuation for Air India.

- This will be necessary as major Indian corporations from outside aviation may not have the appetite to invest in a complex project without an experienced strategic partner.

- The exit of Jet Airways, Air India’s biggest full-service competitor, from the market has further enhanced the chances of a successful disinvestment this time.

Concerns about Divestment:

- Since the Air India is having a huge debt and is not ready to divest 100% of its stakes, bidders are reluctant to bid for it.

- An earlier attempt last year failed to yield any interest, with no entity coming forward to bid for Air India.

- There will be no interest in bidding for the airline unless the government decides to sell 100% in Air India as investors would not find it comfortable even with government retaining 1% stake in the airline.

Source

The Hindu.