Corporate Tax Cut

Why is it in the news ?

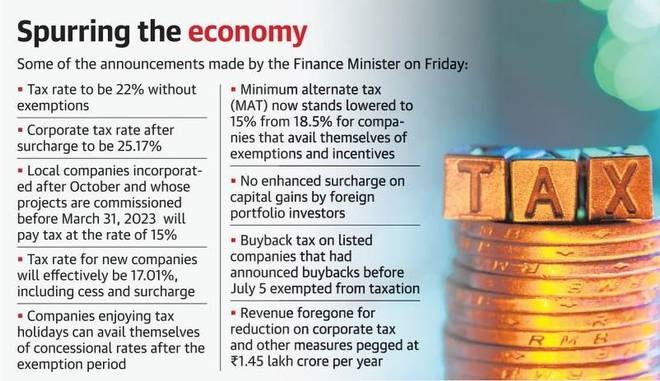

- The government issued an ordinance to reduce the corporate tax rate for domestic firms and new manufacturing units by 10 to 12 percentage points.

- The cuts effectively brought India’s tax rates on par with its competing Asian peers.

More in the news

- Presently (before the tax cut), Corporate tax for domestic companies with annual turnover less than Rs.400 crore is 25%. Above Rs 400 crore, it is 30%.

- The tax cuts also include reduction in surcharge on corporate income tax from 12% to 10%.

- The rate cuts will make Indian companies more competitive globally, and will encourage foreign companies to invest in India, which could boost private sector investments.

- It will increase corporate savings and therefore, also investment and make Indian firms more competitive.

Corporate social responsibility (CSR)

- Government has decided to allow corporate India to use their mandatory corporate social responsibility (CSR) spending for investments in R&D.

- The fund is expected to be invest in publicly-funded incubators and contribute to research efforts in science, technology, medicine and engineering at major institutions and bodies.

Source

The Hindu.