Fund to help housing sector

Why is it in the news ?

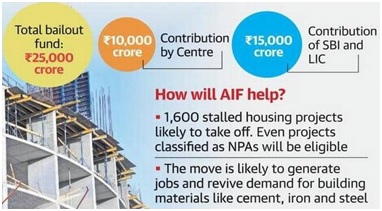

- Government has approved the creation of Alternative Investment Fund (AIF) worth Rs 25,000 crore.

- The fund is to provide relief to developers with unfinished projects to ensure delivery of homes to buyers.

More in the news

- Need: As per the government data, around 4.58 lakh housing units were stuck in India with over 1,600 realty projects stalled.

- Management: SBICAP Ventures will be the investment manager for the fund.

- Expected Outcome: The decisions will help relieve financial stress faced by large number of middle-class homebuyers who have invested their hard-earned money.

- The funds will be set upas Category-II Alternative Investment Fund registeredwith the Securities and Exchange Board of India.

- Alternative Investment Fund (AIF):

(1) The name Alternative is vital as it shows the entities specified as AIFs are not like the traditional institutions – mutual funds, pension funds, insurance companies etc.

(2) Anything alternate to traditional form of investments can be categorized as alternative investments.

(3) AIFs refers to any privately pooled investment fund – a trust or a company or a body corporate or an LLP (Limited Liability Partnership

- AIFs includes Private Equities, Venture Capital Fund, Hedge funds, Commodity funds, Debt Funds, infrastructure funds, etc.

Source

The Hindu.